cap and trade vs carbon tax canada

Whats the difference between taxing carbon emissions and a market-based system of cap and trade. In 2017 Ontario will introduce a cap-and-trade system.

Opinion Why A Carbon Tax Won T Solve Climate Change Climate Change Climate Change Debate Human Behavior

Companies must have a permit to cover each unit.

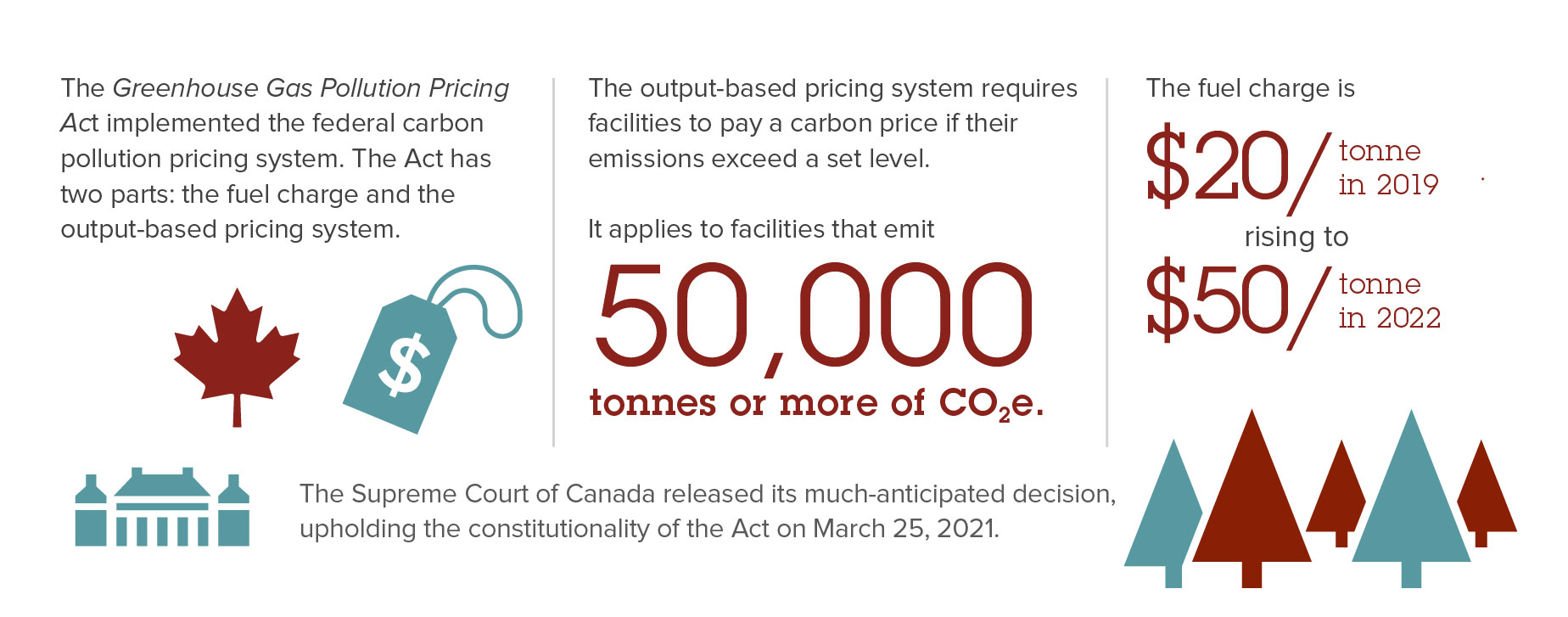

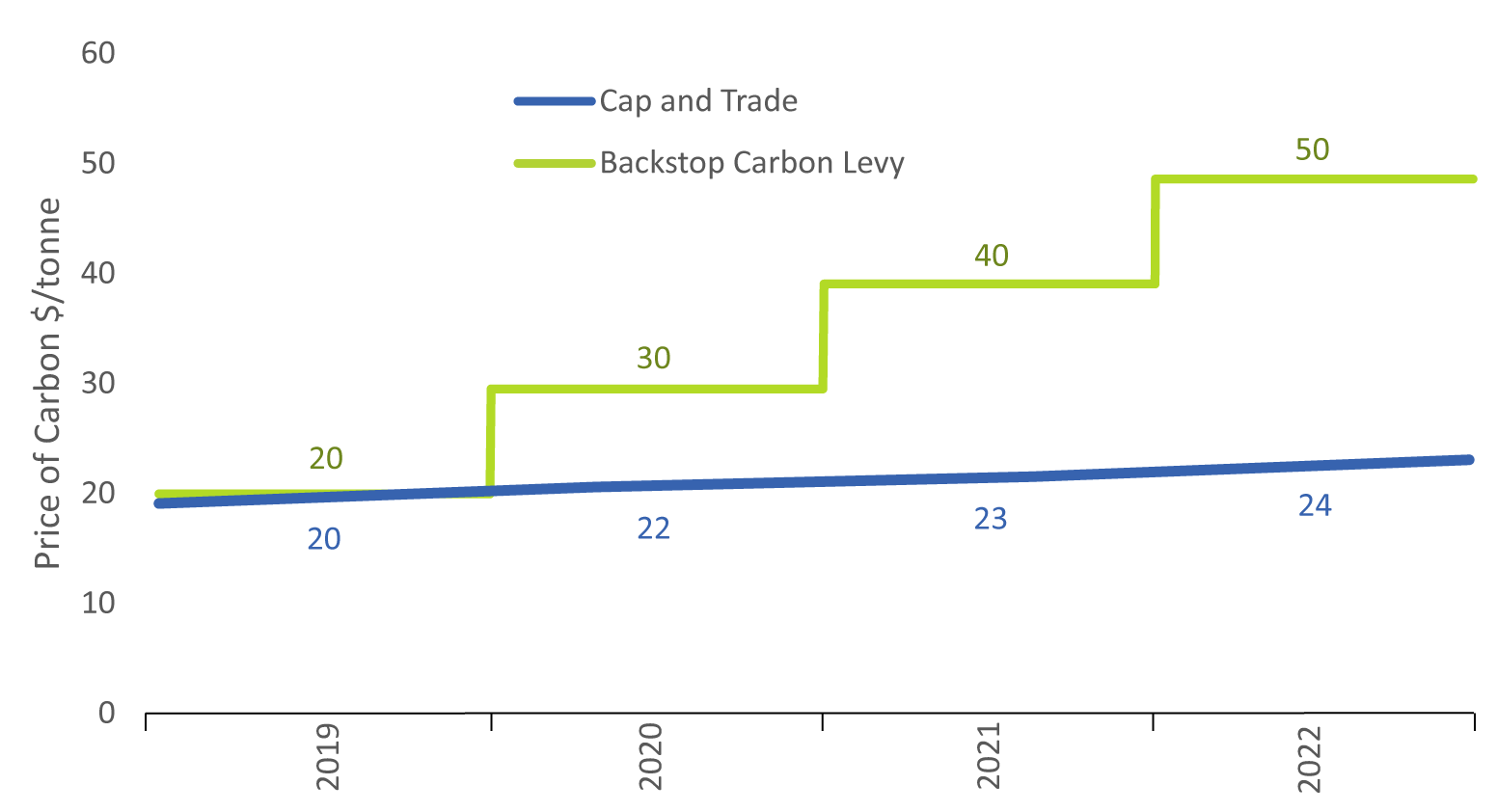

. Those in favor of cap and trade argue that it is the only approach that can guarantee that an environmental objective will be achieved has been shown to effectively work to protect the environment at lower than expected costs and is. Alberta announced it will have a 20-per-tonne carbon levy in place starting next year rising to 30 a tonne in 2018. For consumers the federal minimum price started at 20 per tonne of CO2 equivalent in 2019.

Carbon Tax vs. With cap-and-trade units of carbon are initially given out for free meaning there is no upfront cost to firms. Carbon Taxes vs.

Carbon taxes and cap-and-trade are ways to price carbon but they both have some key differences. Finally in October 2016 the. A cost is added to all emissions equal to the level of the tax and this causes people to cut back.

Quebec also has a cap-and-trade system intended to reduce GHG. One difference is the way the two policies distribute the cost of reducing pollution. There is no cap on emissions in a.

Theory and Practice The ninth in a series of annual discussion papers supported by the Enel Foundation Robert N. Theory and Practice Robert N. A carbon tax sets the price of carbon dioxide emissions and allows the market to determine the quantity of emission reductions.

In certain idealized circumstances carbon taxes and cap-and-trade have exactly the same outcomes since they are both ways to price carbon. H23Q50Q54 ABSTRACT We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and-trade system with a price ceiling andor price floor. Each approach has its vocal supporters.

Carbon footprint Food miles v t e Emissions trading is a market-based approach to controlling pollution by providing economic incentives for reducing the emissions of pollutants. However in reality they differ in many ways. A Carbon Tax Government sets a tax of 3 per ton of emissions.

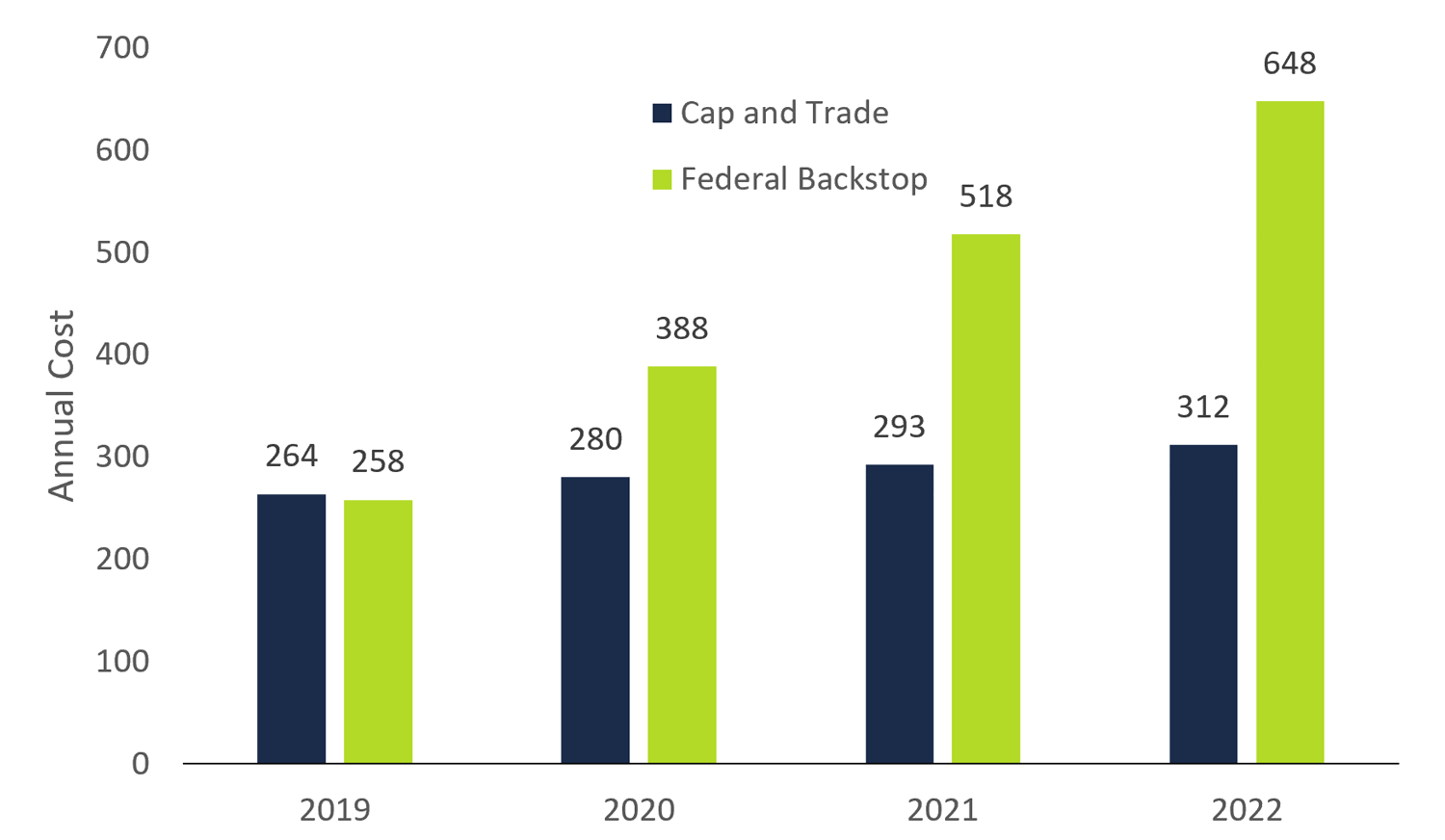

Ontarios fiscal watchdog recently said the cancellation of cap and trade will cost 3 billion in lost revenue over the next four fiscal years. In August 2016 British Columbia which already has a carbon tax released its own aggressive Climate Leadership Plan5 calling for an 80 per cent reduction from its 2007 emission levels by 2050. A Carbon Tax vs Cap-and-Trade The Canadian Chamber of Commerce has released an economic paper titled A Carbon Tax vs Cap-and-Trade analysing the two systems of reducing the buildup of greenhouse gas emissions.

The following are the authors final thoughts on the topic. The paper is written by the Chambers Senior Economist Tina Kremmidas. A carbon tax would appear to take direct aim at consumers while a cap-and-trade system targets industry.

19338 August 2013 JEL No. The harvard project on climate agreements The goal of the Harvard. How much is Canadas carbon price.

Goulder and Andrew Schein NBER Working Paper No. With a carbon tax there is an immediate cost to firms for polluting. Action Plan4 and a cap-and-trade emission control regime aiming for an 80 per cent reduction in greenhouse gas emissions from 1990 levels by 2050.

As of this April its 40 rising to 50 in 2022 and increasing by. The tax will apply. A carbon tax and cap-and-trade are opposite sides of the same coin.

It seems inevitable that some day Congress will pass legislation meant to cut greenhouse-gas emissions. By contrast a cap-and-trade system sets a maximum level of pollution a cap and distributes emissions permits among firms that produce emissions. For firm B the 3 tax is more than the 2 cost to reduce so B pays no tax and eliminates emissions.

Hence at times it is difficult for industries to promote clean energy at a reasonable time to internalize the extra cost imposed on them through a carbon tax. Cap and Trade A carbon tax directly establishes a price on greenhouse gas emissionsso companies are charged a dollar amount for every ton of emissions they producewhereas a cap and. Stavins Harvard Kennedy School.

Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas GHG emissions. Another implication with the imposition of a carbon tax or cap and trade system is that depending on the industry specialization of the country it can result in primarily hurting the industries that are key actors in the local economy. For firm A the 3 tax is less than the 4 cost to reduce so A pays the tax and does not reduce emissions.

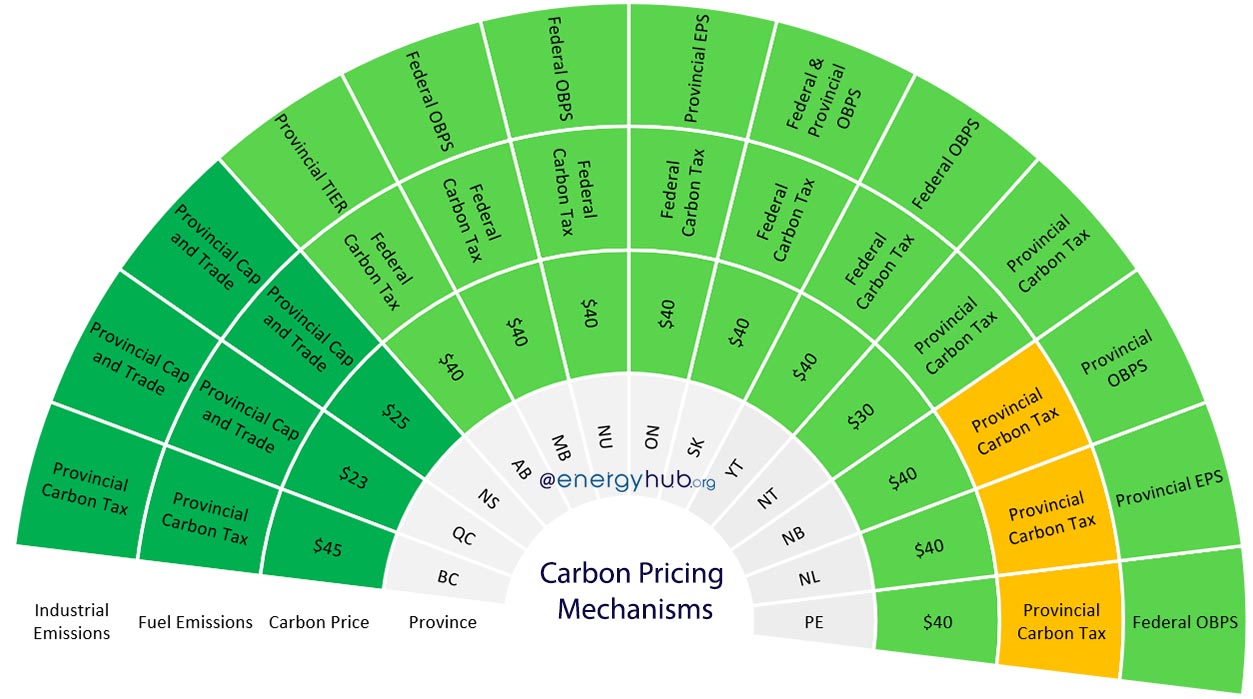

Most of the rest of Canada either already has a carbon pricing plan or will have one. The concept is also known as cap and trade CAT or emissions trading scheme ETS. The Ontario cap-and-trade system aims to reduce emissions by 15 per cent of 1990 levels by the end of 2020 and reduce emissions by 37 per cent of 1990 levels by 2030.

Stavins Harvard Kennedy School November 2019. A Critical Review Lawrence H. Which approach will more effectively reduce emissions.

A carbon tax is sort of the opposite. And it seems likely that said legislation will involve a cap-and-trade system putting a. But there is in fact less difference than one might suspect because the cap-and-trade.

Where Carbon Is Taxed Overview

Bursting The Atmosphere What Happens When Rain Falls Up Ideal Gas Law Rainfall Thermodynamics

44 Ccl Carbon Fee Tax And Dividend Jobs Youtube Dividend Job Carbon

Federal Government S Carbon And Greenhouse Gas Legislation Canada

Climate Change Not Looking So Hopeless A Map Of Climate Change Policies Around The World Link To Pdf Of Source Report In Comments Climate Change Policy Climate Change Climate Policy

Archive World Bank Group President Jim Yong Kim On Twitter Cap And Trade Climate Reality Climate Adaptation

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

The Ief Is Creating A New Methodology For Quantifying Emissions From The Energy Industry Its Chief Economist Tells Ngw In A Methane Online Publications Gas

Canadian Carbon Prices Rebates Updated 2021

![]()

44 Ccl Carbon Fee Tax And Dividend Jobs Youtube Dividend Job Carbon

Nova Scotia S Cap And Trade Program Climate Change Nova Scotia

Where Carbon Is Taxed Overview

Carbon Pricing Vs Carbon Tax Understanding The Difference 2021 04 14 Engineered Systems Magazine

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Green City Times Carbon Cap And Trade Putting A Price On Carbon Cap And Trade Climate Reality Climate Adaptation

Today S Top 5 Environmental Concerns Solar Energy Business Solar Energy Energy Technology

The Carbon Tax For Dummies Why Do We Need It And What Will We Pay Greenhouse Gases Energy Conservation Greenhouse Gas Emissions